EEMEA Gaming Landscape: Value Chain, Trends, and Opportunities

EEMEA Gaming Landscape: Value Chain, Trends, and Opportunities

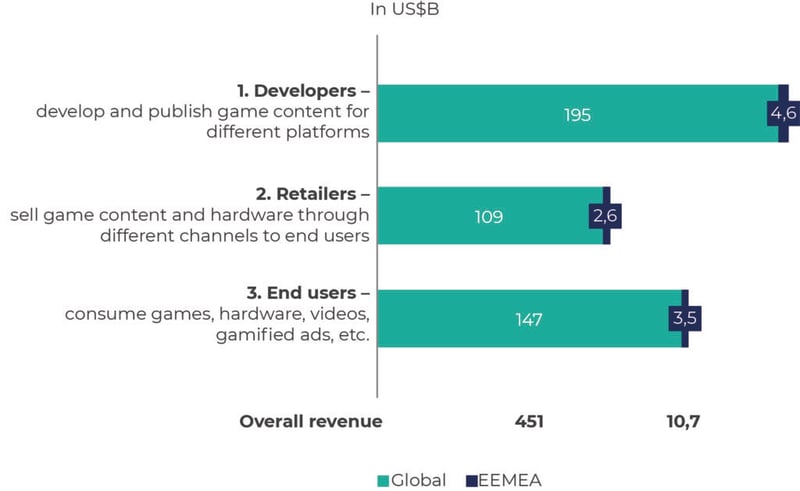

While the EEMEA market is currently small, the gaming payments opportunity is large. Growth is expected to be significant and above the global average, due to the many growth drivers across the value chain. Despite this expansion, there are no significant local game payments solutions, though some global payments providers and large local PSPs are addressing the need. The payments opportunity is ripe for organizations that hone in on and address the unique challenges and needs of the EEMEA region.

As the EEMEA gaming ecosystem matures, strong preferences for mobile gaming – and a persistent Google/iOS duopoly – will shape the opportunity. In the near-term, this could limit opportunities and margins for third-party payments providers due to the hefty commissions levied by big tech gatekeepers. However, an increase in developer ecosystems is expected to spur additional third-party payments growth opportunities, especially as local developer ecosystems become more robust and regulatory changes evolve.

In the longer term, EEMEA is a region of opportunity. As regulations evolve and penetration of non-Google/iOS app stores deepens, new entrants may have a better edge into the gaming payments space. Paired with heavy mobile usage and heterogeneous payments solutions and acceptance, EEMEA gaming payments could be poised for explosive growth.

Snapshot Of The Global Gaming Industry

Gaming is the biggest and fastest-growing segment in the entertainment and media industry combined, with a value chain that is composed of four key-players.

Considerations for Payment Requirements

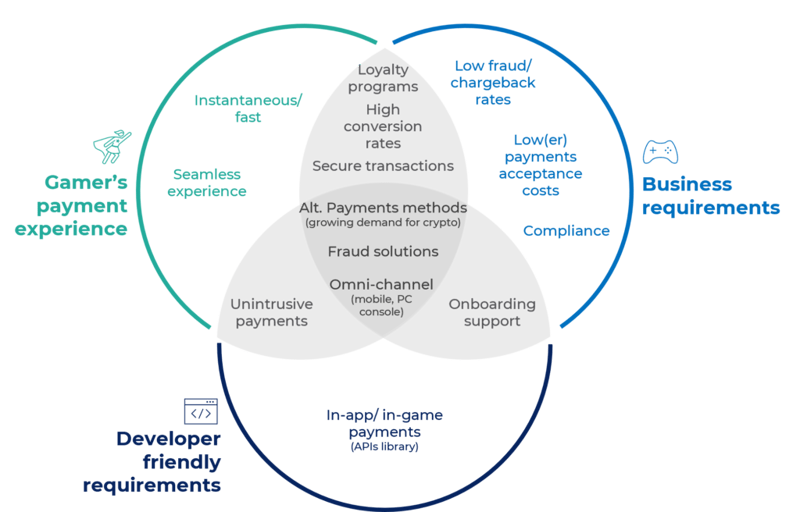

In addition to the size of the gaming segment, payments organizations must also consider the unique requirements of the industry. Any friction within the payment process often results in a failure to convert the gamer into a payer. This presents multi-faceted challenges in balancing stakeholder needs and preferences across experiences.

Gamers want fast, seamless payments experiences, which must be balanced with developer-friendly requirements for in-app and in-game payments. Payments must also be fraud-free, compliant, and achieved at the lowest possible payment acceptance costs. Balancing the gamers’ payments needs with regional considerations and regulatory requirements is no small feat, to be sure. In the following sections, we’ll explore how regional trends in decentralization, technology, and government-led initiatives are shaping the payments opportunity.

Payments Requirements for the Gaming Industry: Mobile gaming has a unique set of payments requirements which must account for the needs of gamers, developers, and app companies.

Source: KoreFusion Analysis

Key Global & EEMEA Regional Trends

Both global and regional trends are rapidly evolving as new regulatory pushes occur, smartphones move the needle in key markets, and government initiatives spur innovation. Each of these drivers touches multiple components of the gaming value chain and may potentially unlock new opportunities for payments solution providers who keep a finger on the pulse of these changes.

The most impactful global trend is the push for decentralization of the App Store market currently dominated by Google and Apple. These tech giants are gatekeepers to gaming payments, charging up to 30% commissions on third-party payment link transactions. Global regulators are working to increase competition in the app market by passing laws that require large tech companies to allow third-party app stores in their mobile operating systems.

On the regional front, the gaming market is growing in EEMEA, bolstered by smartphone penetration and government-led investments and initiatives. Mobile gaming underpins much of the expansion, claiming more than 60% of gamers in MENA and a whopping 95% in the SSA region.

Understanding the interplay between government-led innovation and the regional popularity of mobile gaming as outlined below could prove pivotal in exploring payments solutions for gaming.

Turkey & Pakistan – Turkey has become the Silicon Valley of the regional mobile gaming industry, with the second-largest gaming ecosystem in Europe. It is the eighth biggest country in mobile gaming by revenue, hauling in US$ 2.3B in 2021. Pakistan is a mobile-first gaming market, with mobile games generating US$ 171.30M in 2022.

KSA – Gaming consumption in KSA is projected to reach US$ 6.8B by 2030, increasing by an average of 22% CAGR. Savvy Games, a subsidiary of the Public Investment Fund (PIF), acquired ESL gaming and FACEIT among other efforts to build up its stakes in gaming and esports over the past two years.

UAE – Nine in 10 adults in the UAE play video games, and gamers in the region generated US$ 520M in revenue in 2021. AD Gaming, a collaborative, government-led program, caters to gaming professionals to develop a self-sustaining gaming ecosystem.

Egypt – Egypt’s true potential as a gaming market remains to be realized, though opportunities exist. While MENA’s largest nation has just 57% internet penetration, it has the highest number of gamers at 38 million — and 92% of people between 16 and 24 years old engage in mobile gaming.

Sub Saharan Africa1 – The number of gamers in sub-Saharan Africa increased to 186 million people in 2021 from 77 million in 2015. The bulk of these (95%) are mobile gamers, driven by increasing digitization across the continent. African gamers spend 16 minutes per day on mobile gaming— with mobile data consumption in SSA expected to almost quadruple from 2.9 GB monthly to 11 GB within the next four years.

Emerging Developer Networks

The landscape for EEMEA game developers can broadly be segmented into three categories: global developers, acquired local and regional developers, and local developers. Government-led and private initiatives are strengthening the ecosystem, unlocking economic potential, and driving long-term growth, including:

- Pan Africa Gaming Group — an association of 10 game studios from 9 different countries in Africa formed in 2022.

- Savvy Games Group — a games and sports company formed by the Public Investment Fund (PIF), KSA in 2021.

- AD Gaming — a government-led initiative covering efforts throughout Abu Dhabi to transform Emirates into a global gaming hub.

As the developer landscape evolves in tandem with mobile gaming growth and popularity, payments opportunities in the market will expand. Taking advantage of these opportunities will require a watchful eye on key regulatory reforms.

Regulatory Reforms & The Future of Payments

Thus far, we’ve explored the size of the market, regional trends, government participation, and the role of developer networks. Yet perhaps one of the most impactful factors to gaming payments innovation is regulation, which is changing in response to the growing market.

More specifically, regulatory shifts have occurred in the wake of the Epic Games lawsuit against Apple in 2020, which challenged Apple’s restrictions on apps that disallowed other in-app purchasing methods other than that offered by the App Store. While Epic lost that battle, the larger fight continues with many regulators stepping in to legislate changes.

Both Google and Apple have vigorously defended their turf. Apple does not allow the installation of any third-party app in iOS without using its App Store. Google allows the installation of third-party apps without using Google Play Store but requires the user to enable various developer options.

While both platforms now permit some forms of third-party payments, they charge hefty commissions. Apple charges a 26% commission on the price paid by the gamer, while Google charges developers 12% for the first $1 million in developer revenue and 27% thereafter, leaving little room for margin after MDR has been paid by the developer.

In the EU, the Digital Market App Act asks large tech companies to allow third-party app stores in mobile operating systems beginning in 2024. Apple has already made adjustments to comply, rolled out as part of iOS 17 this year. Both South Korea and the Netherlands have also passed laws allowing the use of third-party payment providers, with the EU and US following suit.

Both Google and Apple are allowing developers to use third-party payments providers in regions where regulations are changing.

Conclusion

While the popularity of gaming is a global phenomenon, its expansion in EEMEA is driven by unique market characteristics, including smartphone penetration and mobile gaming popularity, emerging developer networks, government initiatives, and the heterogeneity of payments methods in the region.

There is a myriad of grassroots drivers of regional gaming payments solutions, though more will be revealed as regional regulations advance and incumbents respond accordingly. The key for payments companies is to understand the current trends and intuit where future winds may blow, especially regarding regulatory movements. The opportunities will reveal themselves to those who pay attention.

KoreFusion is at the forefront of gaming payments research. Our deep knowledge of the industry and regional trends enables us to offer valuable guidance to payments organizations looking to expand to new markets. For more information about how we can help, please reach us at information@korefusion.com.

1Seas Monster (South Africa), Kayfo Games (Senegal), Kiro1o Games (Cameroon), Leti Arts (Ghana), Digital Mania (Tunisia), Qene Games (Ethiopia), Usiki Games (Kenya), Khanga Rue (Tanzania), DoepApps (Rwanda), Masseka Games (African Diaspora)

Author:

KoreFusion

Share: