KF Payments Perspective – Summer 2016: The Impact of Brexit on FinTech

Herein, and in light of last week’s referendum in the UK, we’ve compiled some of our thoughts regarding how the FinTech industry will likely be impacted by Brexit. This is the first in a series of articles that will explore this topic, and focuses on macro trends. Subsequent articles will measure the impact on specific sub-segments within FinTech and the spillover to other global regions. (Spoiler Alert: not all is lost).

KoreFusion Payments Perspective – Summer 2016

The Impact of Brexit on FinTech: Recalibrating Six Drivers

At KoreFusion part of our job is to explore the consequences of Black-Swan events and play-out “war-gaming” exercises. Most times we are tasked with mapping the consequences of events like: “What if Google or Apple give payments services away for free in exchange for rights to the transaction data?” or “What will happen to interchange rates if real-time payment platforms become the new consumer payment standard?”.

Herein, and in light of last week’s referendum in the UK, we’ve compiled some of our thoughts regarding how the FinTech industry will likely be impacted by Brexit. This is the first in a series of articles that will explore this topic, and focuses on macro trends. Subsequent articles will measure the impact on specific sub-segments within FinTech and the spillover to other global regions. (Spoiler Alert: not all is lost).

Please let us know if you are interested in discussing our detailed assessments and how they impact your business. You can reach us at information [-at-] korefusion.com

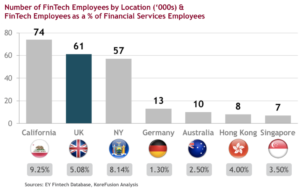

- Certain Becomes Uncertainty

The UK is home to 1,500 of the world’s FinTech start-ups, and 40% of Europe’s; employing 61,000 people and generating $9.5 billion in overall revenue last year. Well-known brands like TransferWise, Currency Cloud and Funding Circle call the UK home. FinTech was a very bright spot in an otherwise lack-luster economy, and London was set to give Silicon Valley a run for its money.

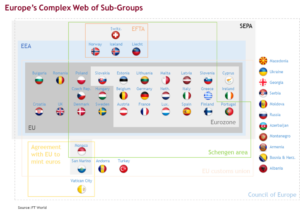

Paradoxically, after the referendum, none of this will immediately change, and yet the very uncertainty of what will now happen means everything will begin changing at once. The type of agreement that is negotiated with The EU will influence what scenario unfolds for Britain. No special relationship; a broad trade agreement; multiple bilateral agreements by sector; membership in the European Economic Area? There is even the possibility that the results of the referendum could be walked back.

Under any given scenario there are questions regarding the compliance requirements around European-level initiatives and both the second Payment Services Directive (PSD II) and the pan-eurozone SEPA. Everything from the validity of bank license passporting, to customer on-boarding, to KYC/AML protocols, and standards for security/authentication are in flux. Even personal data privacy is in doubt—who will be allowed to access whose data, and from where?

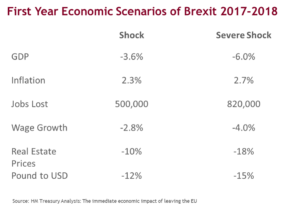

For the UK FinTech industry, the outlook seems bleak. Few people want to make investments in an environment surrounded by fear and uncertainty. In this scenario, the best plan is to assume the worst case scenario and build from there.

- Fundraising Dries Up

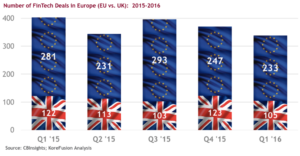

During the last two years, UK FinTech had healthy access to capital, although relative to the US, it demonstrated softness in the Development and IPO stages. Brexit will immediately deteriorate the ability to raise funds, but how this unfolds over the next couple of years will be mottled, and even offer potential upsides, for FinTech companies.

In some respects, the global FinTech industry already anticipated leaner teams. Many veteran investors recall the big tech crash of 2000 and were sounding alarm bells on outsized valuations and calling for a less frothy funding environment. FinTech valuations in 2016 are less exuberant than a year ago, and focus is shifting from “scale-at-all-costs” to positive per unit economics. Lean times will inspire further discipline and creativity.

Seed capital in the UK will be significantly reduced, almost instantly, and likely not return to 2015 levels until the terms of Britain’s exit are clear. At that point, new players will still benefit from British regulations that encourage startups, but they may not be able to exercise these advantages in the EU. For companies singularly focused on the British market however, this could actually prove to be a protective moat—offering a home court advantage while limiting the interest and agility of European outfits in the UK.

Contraction will also occur at the other end of the spectrum - there will be fewer IPOs and hundred-million plus rounds of funding. It is likely unicorns—who are too expensive to be acquired by incumbent tech companies or banking players---will lose their billion dollar valuations. In the long term this will catalyze a likely uptick in corporate and financial buyer acquisitions. Many multi-national corporates and American PE firms have enormous dry-powder reserves and are eager to get into the FinTech space, but are put-off by exaggerated valuations. Chinese investors have also shown a healthy and growing appetite for FinTech acquisitions, but are equally skeptical of current valuations.

The middle ground for funding will take the longest to play out. Caustic uncertainty regarding regulation and scale will mean institutional investors will devote less capital to VC funds and fewer new companies will be funded. We estimate that £1.6 billion, from 140 active VC funds, are in peril of being delayed or diverted from British Fintech over the next two years.

Furthermore, the first quarter of 2016 saw record Series A and B rounds, and this capital is yet to be deployed. The fluctuation of the pound, which initially plummeted after the referendum, will impact these recent valuations and investment costs. The beneficiaries will have to choose wisely how to redirect their resources, knowing that meeting their funding milestones has become much more difficult. Many may unfortunately fail, but the victors will emerge the better for it, and be strong contenders for the venture funds of an oversubscribed American VC market.

On a positive note, new ventures can still take advantage of regulatory support from the UKs Financial Conduct Authority (“FCA”) and funding from the EU. In May of 2016 the FCA and the Monetary Authority of Singapore (“MAS”) signed regulation that refers FinTech firms to their counterparts across the globe. This type of regulatory initiative may suddenly seem irrelevant, but is actually a valuable life-line to Asian markets and capital. The British government will likely continue with other tech-bridges in priority markets.

- Talent Shifts But Is Not Gone

The combination of a devalued pound sterling and impending work-permit uncertainty are regarded as a real negative regarding the UK’s ability to attract and retain first class talent going forward. FinTechs estimate they need to relocate 10% to 40% of their workforce as a matter of course. Yet, the UK is already suffering from the inability to efficiently attract FinTech talent, particularly among data-scientists, and is losing top recruits to the Continent. Brexit may actually alleviate this pressure over a mid to long term horizon, as British firms are freed from EU regulations that limit their ability to attract talent from countries outside of the EU.FinTechs in the UK rely on importing technical talent from tech-savvy countries like Latvia, Hungary, Estonia, and Bulgaria, and EU regulations heavily favor hiring Europeans. There is not enough talent however to satisfy demand, and salaries are being inflated. The UK’s position is further aggravated by Germany, Ireland, and the Netherlands who are aggressively courting FinTechs with tax incentives, nimbler regulation, and investments in connectivity infrastructure. “Poor but sexy” Berlin offers cheap rent, good connectivity, and a night life that appeals to young talent. It already hosts many vanguard disruptors to financial sevices.

The UK has a historical and language affinity with India, but has not been able to hire Indian tech talent easily, because of EU regulations. Although the UK will lose some or most of the benefits of reciprocal EU immigration laws that give it access to legions of European programmers, this shortcoming could be amply covered by India, and analogous argument could also be made for China. A devalued pound combined with more available English speaking talent could even help the UK compete as an outsourcing option for American companies, along the lines of Dublin.

The Leave campaign’s proposal to introduce a Canadian and Australian-style points system is what will most likely replace the current EU labor program. The new scheme is criticized as too laborious and slow for FinTech companies. That criticism may be undue however, because it already exists today and was well received by the British FinTech community. The initiative is known as “Tech Nation Visa Scheme” and was enhanced by the British government in late 2015 as a means to augment the qualifying criteria for non-European digital experts so they can obtain a visa to work in the UK.

In the short term, constricted capital flows will likely damage operations and lead to lay-offs. Ventures that were planning to raise capital this year will be the most affected, and many of them may contract or disappear. Here too however, there may be a silver lining. The outflow of talent from smaller outfits will increase the labor pool and alleviate salaries until the effect of longer term programs like Tech Nation Visa Scheme kick in. Relief on salaries will help companies that did secure funding extend their runways and more easily access talent.

- Passporting Headache

The UK’s open-minded Financial Conduct Authority (FCA) and speedy licensing process, made it attractive for FinTechs to set up there. Once licensed, they could then sell their products and services across the EU bloc, an arrangement known as “passporting”. Passporting provided FinTechs the ability to very quickly scale across the EU.

These “passports” obtained in Britain technically have two to three years before they expire, if they expire, but many FinTechs now consider them de-facto lame-ducks. France’s Central Bank governor warned that British banks’ (and by extension many FinTechs’) passporting rights are at risk of being partially or entirely abolished depending on the outcome of negotiations. Considering neither the US or Switzerland has passporting with the EU, it is unrealistic to assume the new UK will.British FinTech companies wanting to continue selling services or retail products to clients in the EU, will first need British rules to be deemed “equivalent” by the European Commission and European Securities and Markets Authority (ESMA). In the immediate term this should not be problematic. Assuming the UK will correctly implement MiFID II over the course of the next two years, UK legislation will be a de facto equivalent to the legislation in the EU.

Problems will arise soon thereafter however. The UK already does not agree with all aspects of EU regulations, and once it is unbound from the EU, will make its own determinations. This will immediately invalidate any measure of equivalency to the EU legislation. Furthermore, the very commissions that defined equivalency relied heavily on the UK’s expertise, and once it leaves the EU, this representation and influence will be lost.

Losing passporting privileges is not insurmountable, but adds another layer of distraction to FinTechs. The safest solution is for FinTechs registered in the UK to seek new and redundant certifications issued in Europe. Our initial calculations indicate that over 2,000 British and non-European FinTechs that leveraged Britain as a passport to the EU will have to re-license on the Continent.

- Sandboxing Advantages Curtailed

Britain dominated Europe’s FinTech scene in large part because of a key, yet oft overlooked component of its friendly regulation: a provision by the FCA to create a regulatory sandbox. The FCA described it as “a “safe space” where businesses can test new products, services, business models and delivery mechanisms while ensuring that consumers are appropriately protected”.

Although in existence little more that two years, it transformed Europe’s FinTech landscape because it allows companies to experiment without the usual compliance burdens, and supports them with a tailored authorization process and guidance in the testing phase. Combined with passporting, this was a powerful driver of the UK’s FinTech boom.

With the rescindment of passporting, the sandbox scheme is only relevant to the UK market. Amsterdam, Frankfurt, and Dublin are already very friendly alternatives to London, and they can all solve the issue of passporting, but unfortunately no other European country has an equivalent sandbox scheme.

Hopefully a European scheme will emerge in time to compensate for the loss of the UK’s sanboxing. If not, it will be sorely missed, and slow the rate of innovation and roll-out across Europe.

- Scale in Doubt

British FinTechs have the best of both worlds: easy testing and passport requirements in the UK, and a European mawith 742 million consumers across the Channel waiting for successful scaling. This will end.

The UK domestic market has 65 million consumers, but is hard pressed to provide good pasture for unicorns by itself. In the unlikely event that the UK dissolves, the English domestic market shrinks to only 54 million consumers. Europe can better cope with the absence of the UK when scaling than vice-versa, but it will take it some time to catch-up to where the UK already is in terms of FinTech pipeline.

The English language and culture, together with the banking strength and sophistication of The City of London, make the UK the first port of call for many international financial services and FinTechs. The UK pressed these advantages hard along with its sandbox scheme and ability to passport into the rest of the EU. The loss of these advantages is a serious handicap.

American FinTech CEOs and investors will be forced to measure the UK in isolation against candidates they historically shied away from, because they were outside of their linguistic and cultural comfort zone. Germany is 20 percent larger and opens the doors to the EU. Mexico is a neighbor that is twice as large as the UK, intimately tied to US market, and a natural bridge to another 500 million consumers across Latin America. The Trans-Pacific Partnership has opened the door to Southeast Asia, which in KoreFusion’s opinion, is a massive latent FinTech ecosystem awaiting a catalyst.

Closing Thoughts

Reviewing how Brexit will transform these drivers, it is hard to escape the conclusion that a rising star is about to wobble, lose momentum and diminish in intensity. Surely many micro-sectors within British FinTech will suffer, and the collateral damage will spill over to international markets. Yet some FinTech micro-sectors will actually benefit from uncertainty and the new order. These are themes we will explore in our next articles on this subject

All that not withstanding, the UK’s VC and FinTech ecosystem is intertwined with the rest of Europe, so that any dislocation will span years. FinTech entrepreneurs are savvy and bold navigators - they will find new ports to call home, and wherever they go, investors will be sure to follow. Before the tide goes out entirely, we may yet see a flurry of activity and investment—much like the frenzy of a shipyard before a thousand ships sail.

Download the PDF: Summer 2016 Payments Quarterly - The Impact of Brexit: Recalibrating Six Drivers

We welcome your thoughts and opinions.

The KoreFusion Team

You can reach us at: information@korefusion.com

Author:

Jan Smith

Share: