.png)

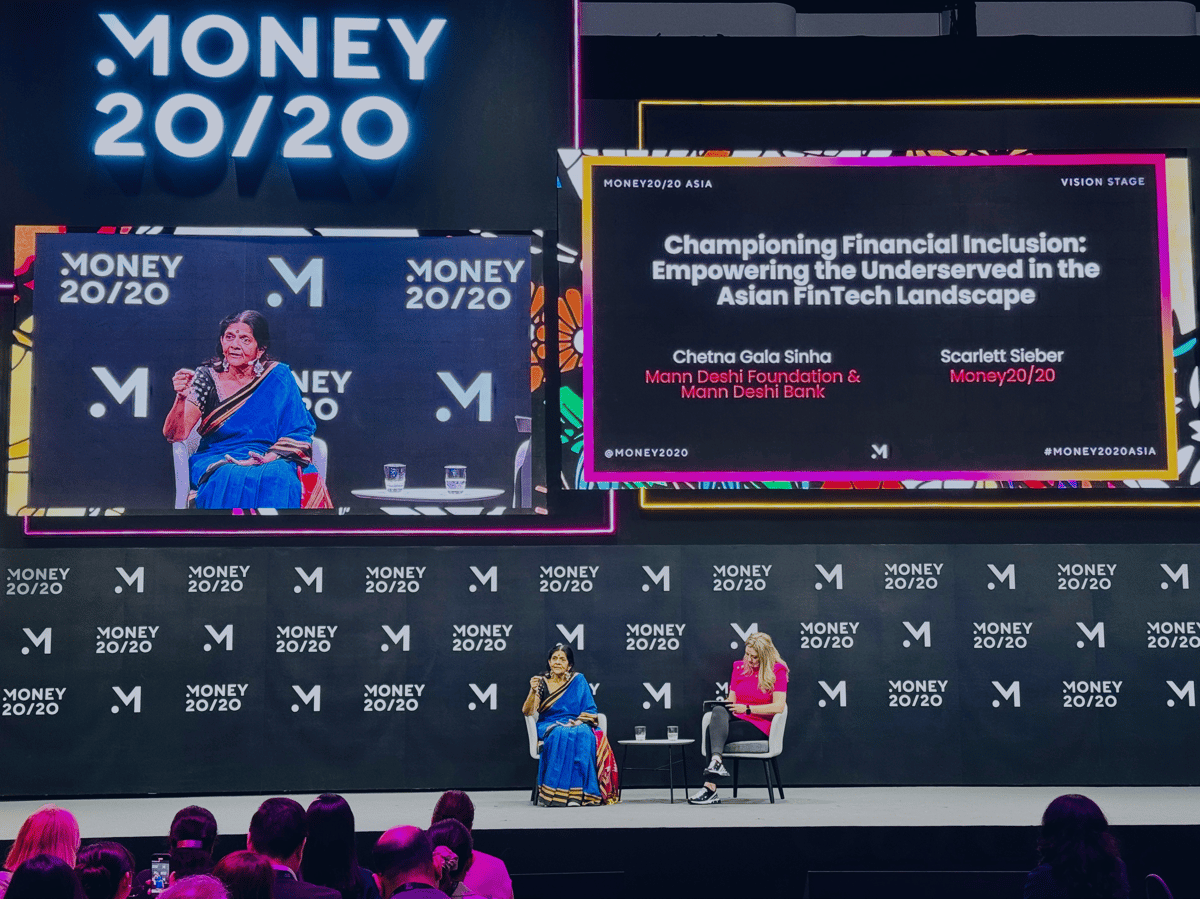

Key Insights from Money20/20 Bangkok 2024

KoreFusion recently participated in Money 2020 Asia in Bangkok, where we gathered key insights into the evolving landscape of the payments industry. This conference offered a unique lens into the dynamics shaping financial services, with a special focus on emerging markets and cross-border transactions.

We want to provide you with some of these gathered insights. If you have questions, don't hesitate to reach out to us!

1. Dominance of Digital Wallets:

2. Cross-Border Expansion:

A significant push for international collaboration is underway. The technology for seamless cross-border payments exists, but effective implementation relies heavily on cooperation across entities. The Bank for International Settlements (BIS) is actively working with central banks to develop solutions, with over 70 countries either developing or having launched cross-border payment systems.3. Growth in E-Commerce Across Borders:

Cross-border e-commerce, particularly from China, has maintained robust growth with exports experiencing double-digit growth rates. Globally, the e-commerce market is projected to reach $5.4 trillion in 2022.4. Regulatory Challenges and Opportunities:

- Differing regulatory environments pose challenges; the Middle East has recently implemented policies that are more favorable to fintech developments compared to more stringent environments like the U.S. In Asia, regulatory sandboxes have become a popular method to test new financial technologies safely.

- Adaptable regulations are crucial for innovation. Countries like Thailand are leading with open banking frameworks that could serve as models for worldwide adoption. Moreover, global mobile payment transaction value is expected to surpass $12 trillion by 2027, emphasizing the need for regulatory frameworks that can support such growth.

5. Technological Innovations Spearheading Change:

Artificial Intelligence and blockchain are at the forefront of payments innovation. For example, AI-driven payment authentication improvements have led to a reduction in false declines by up to 30%, enhancing both security and user experience.6. Financial Inclusion:

Innovations are lowering entry barriers to global markets. Small-ticket cross-border payments (under $100) have increased by 15% over the last year, contributing significantly to financial inclusion in developing regions.

The future of payments will likely see greater alignment between regulation and innovation, with adaptable regulations and increased accessibility becoming crucial. The ASEAN region is opening up, providing a fertile ground for 'coopetition'—where entities compete yet also cooperate in the payments ecosystem.

For detailed insights on leveraging these global trends to enhance your business strategies, please reach out to us at information@korefusion.com.

For detailed insights on leveraging these global trends to enhance your business strategies, please reach out to us at information@korefusion.com.

Author:

KoreFusion

Share: